By

Eugenio Garcia

Jan 30, 2026

RWA Adoption

Growth Was Persistent, Not Reflexive

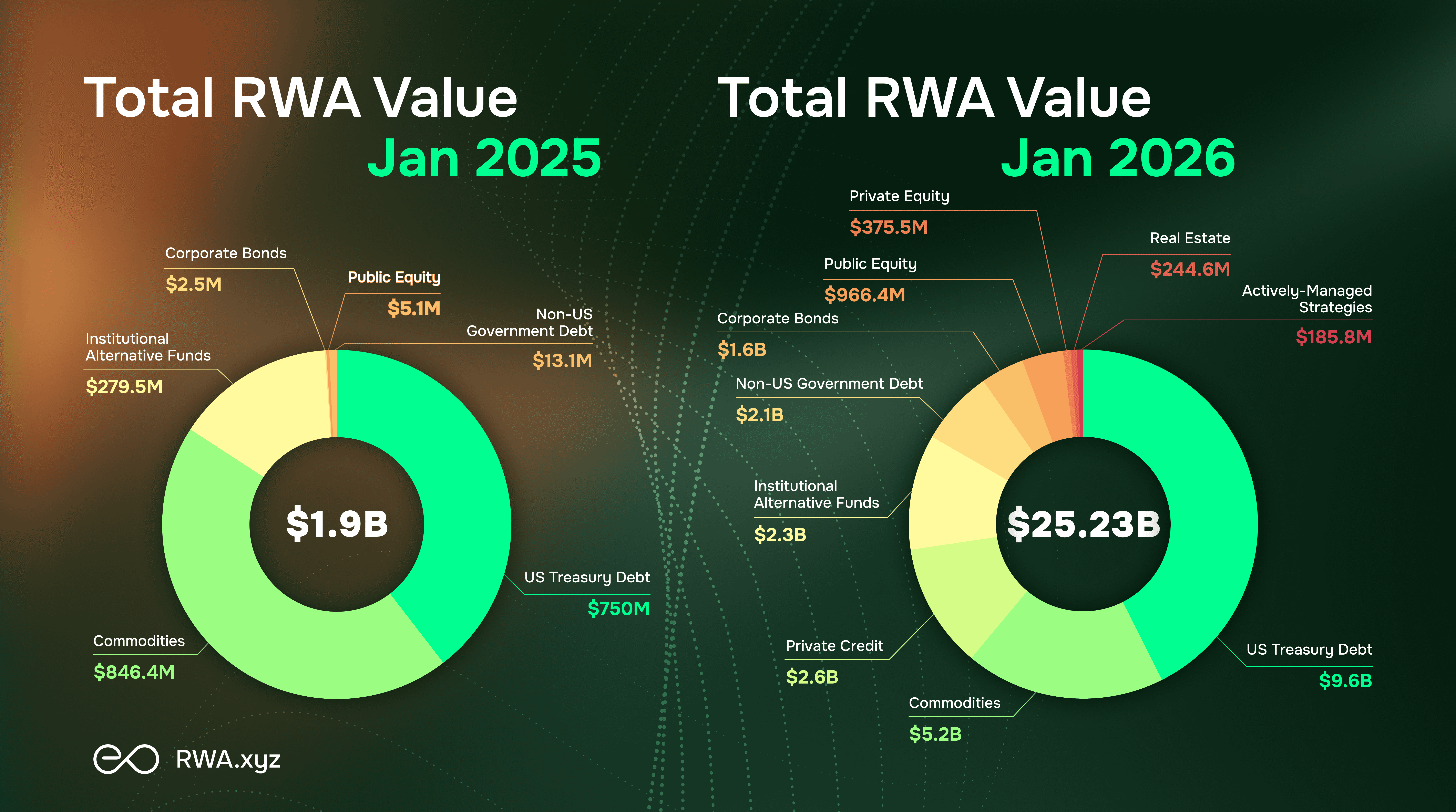

Based on RWA.xyz data, the on-chain RWA market is now:

More than 10× larger than at the start of 2024

Over 4× larger than at the start of 2025

This growth matters less for its speed than for its character. Capital entered gradually, remained deployed, and expanded alongside supporting infrastructure. This was not a reflexive DeFi cycle. It reflected balance-sheet decisions made under operational constraints.

The critical issue is not the pace of future RWA growth, but the reasons certain assets already function today.

Market Composition Reveals Functional Readiness

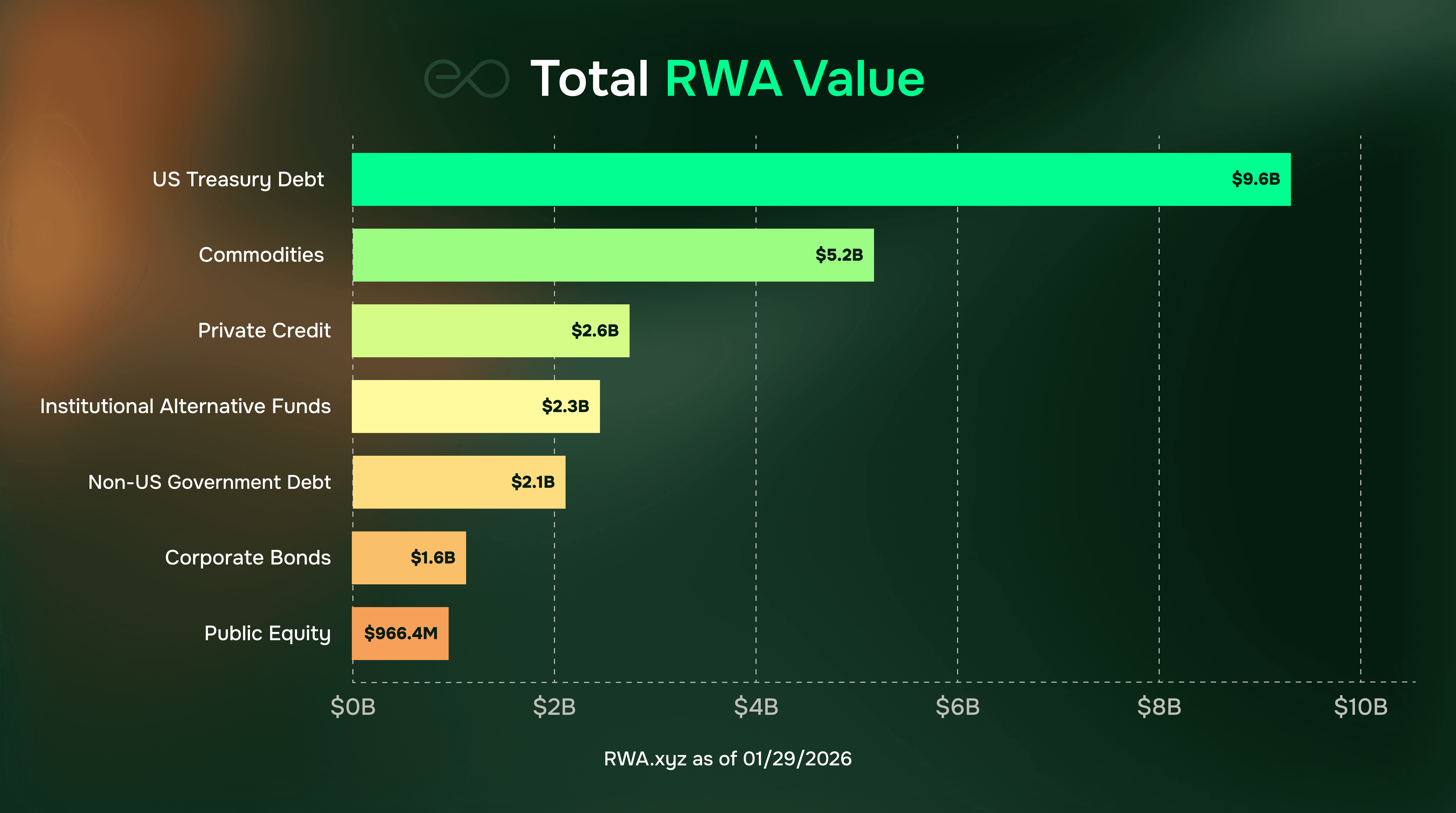

Looking beneath the aggregate number clarifies the picture. As of early 2026:

Tokenized U.S. Treasuries account for roughly 40–42% of on-chain RWA value

Commodities, driven largely by tokenized gold, rank second

Private credit sits third, at approximately 11–12%

Equities, ETFs, and other instruments remain smaller, though emerging

This ordering is not accidental. It reflects how difficult it is to make each asset type operationally usable on-chain.

Valuation Pressure Is a Structural Constraint, Not a Reporting Issue

This distinction mirrors pressures already visible in traditional private markets. In its Global Private Markets Report 2025, McKinsey documents a widening gap between reported asset valuations and realizable market prices. In 2024, near-maturity private equity assets were valued about 17% higher than current market-clearing prices, a gap that was significantly larger and more consistent across sectors than in past cycles.

McKinsey treats this gap not as an accounting anomaly, but as a systemic constraint. As holding periods lengthen and exits remain backlogged, valuation uncertainty directly affects liquidity, capital recycling, and investor confidence. When marks drift too far from realizable value, Markets slow when capital cannot move with conviction due to valuation uncertainty.

The implication is operational. Assets do not fail because they lack demand only; they fail when their value cannot be trusted at the cadence required by modern markets.

Tokenization Becomes Real When Assets Are Usable

At the World Economic Forum, discussions around tokenization increasingly focused on usability rather than novelty. Brian Armstrong framed the shift in access terms:

“There’s actually an unbrokered segment of the world… about 4 billion adults who don’t have access to high-quality assets like the U.S. stock market.”

He also noted the expanding scope of assets moving on-chain:

“We’re now seeing that happen with U.S. equities, real estate, corporate paper, commodities… all kinds of things will come on-chain.”

Access alone, however, does not create functioning markets. Assets become usable only when they can be priced, monitored, and integrated continuously.

That distinction explains why growth clustered where it did.

Tokenization as a Systemic Shift, Not a Narrative Trend

In a Legends Live interview hosted by Citi, Larry Fink described tokenization as one of the defining forces reshaping finance:

“There’s two [megatrends]… AI and tokenization of financial assets. Those are going to totally reshape financial services.”

The implication is operational rather than ideological. Tokenization reshapes finance when assets are compatible with modern systems for analytics, reporting, settlement, and portfolio construction. Without those layers, tokens remain representations. With them, they become infrastructure.

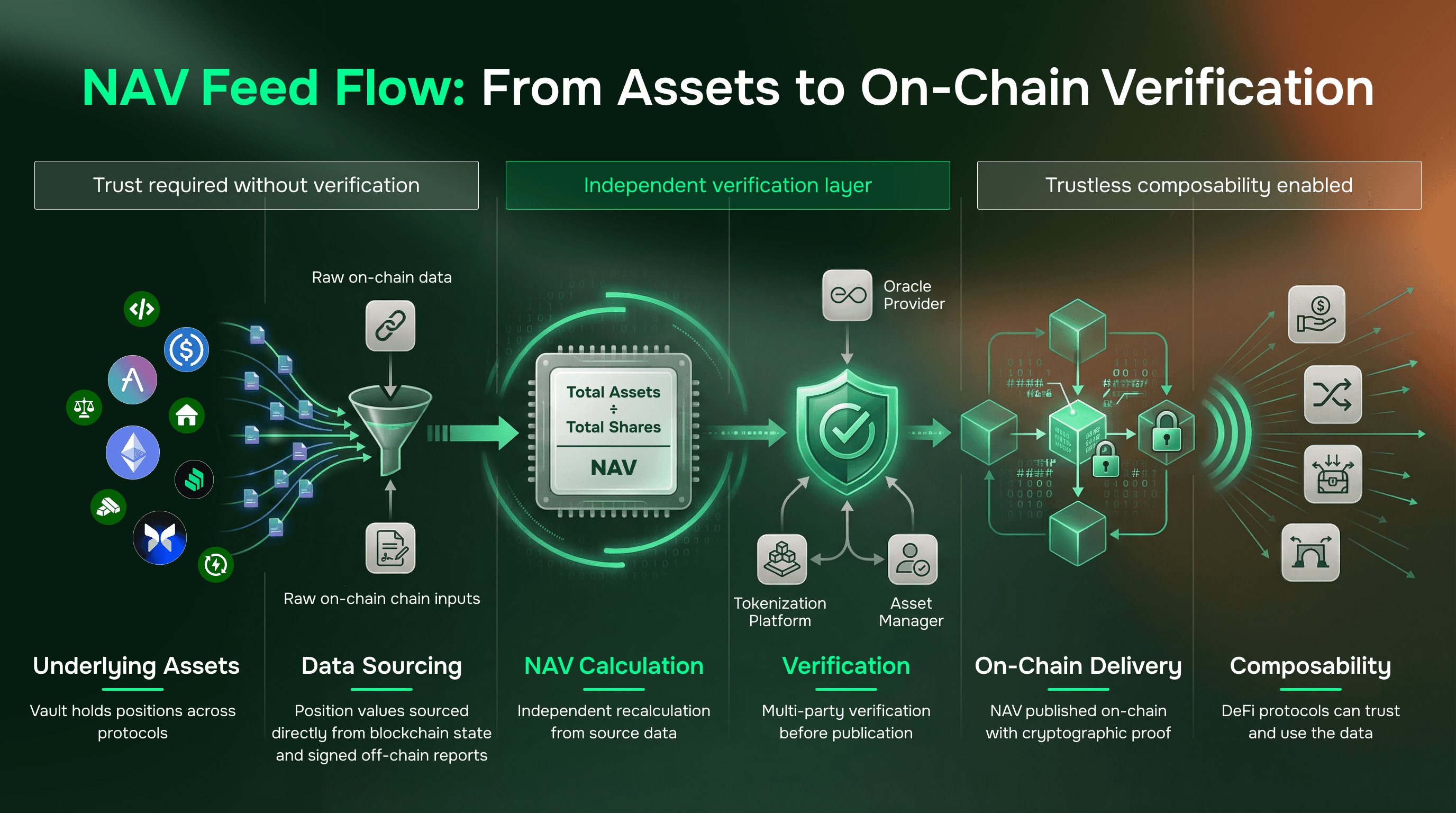

Verification Is the Enabling Layer

The limiting factor for most RWAs is not demand. It is verification cadence.

Tokenized treasuries work because valuation is observable and refreshes continuously. Commodities work when reserves and inventories can be audited credibly. Private credit works only when net asset value (NAV) can be calculated independently, updated reliably, and delivered on-chain in a form that protocols can consume.

Without this, assets cannot be used safely as collateral, integrated into lending markets, or incorporated into automated risk frameworks.

This is where EO Network becomes structurally relevant. EO operates as a data and verification layer designed to translate off-chain financial reality into on-chain systems that require determinism, auditability, and continuous monitoring. Its role is not to accelerate growth, but to make utilization possible by ensuring that NAV reflects independently verifiable inputs rather than issuer self-reporting.

What the Next Phase Depends On

The next stage of RWA growth will be selective. Assets will scale when they meet three conditions:

Clear data provenance — transparent sources and methodologies

Risk-aligned update frequency — valuation cadence matched to usage

Protocol-grade usability — compatibility with lending, collateral, and settlement logic

Treasuries already satisfy these conditions. Commodities do so selectively. Private credit does so when verification infrastructure is in place.

The first $20B demonstrates that these conditions are achievable. The next $100B will depend on how widely they are implemented.

From Milestone to Market Function

The significance of the $20B milestone derives from its functional implications rather than its absolute size.

It reflects:

Institutional capital

Balance-sheet decision-making

Risk-aware deployment

Infrastructure-dependent growth

The early RWA market is no longer theoretical. A portion of it already works. Future expansion will not be driven by more tokens alone, but by whether more assets can meet the same operational standards.

The first $20B shows what functional on-chain markets look like. The next phase will be defined by how far that functionality can extend.

Read more at eo.app