By

Ron B.

Jan 6, 2026

RWA Adoption

I. Introduction

II. The Partnership: Institutional Finance Meets Blockchain Infrastructure

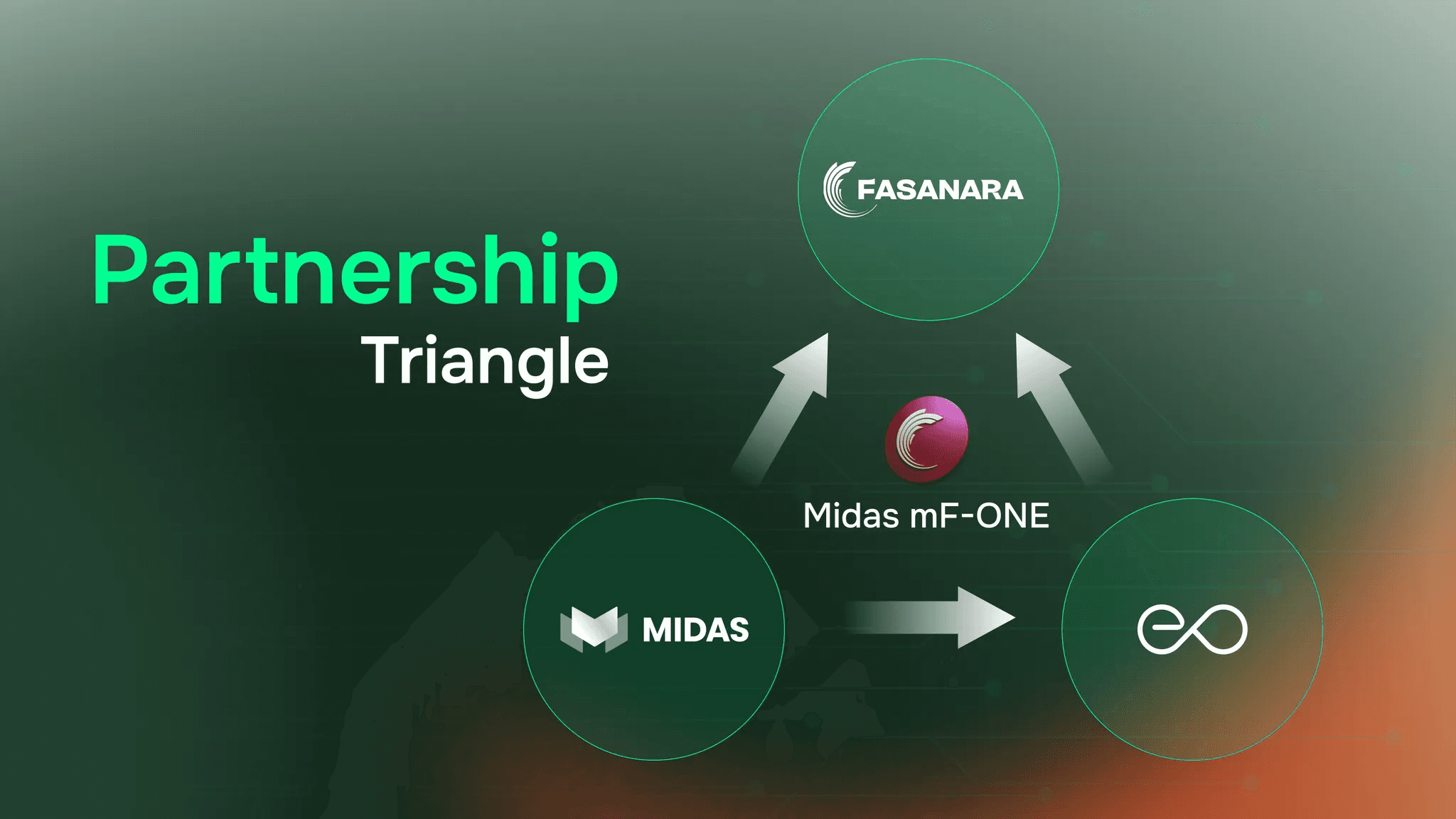

Three players made mF-ONE possible. Each brought specialized expertise.

Fasanara Capital: The Asset Manager

Founded in 2011, Fasanara manages over $5 billion in assets on behalf of pension funds and insurance companies across Europe and North America. With 14 years of track record and a 120-person team, they've built a proprietary technology platform integrated with 141 fintech lending platforms across more than 60 countries. Their reach: over 105,000 SMEs helped, 7 million loans across credit portfolios, and more than $115 billion in cumulative traded volumes.

Fasanara pioneered Fintech-originated Asset-Based Lending, understanding both institutional standards and digital infrastructure. They launched one of the industry's first market-neutral approaches to digital assets, combining institutional rigor with blockchain expertise.

For mF-ONE, Fasanara brings institutional-grade private credit strategies on-chain. Daily audit reports, fund accounting standards, rigorous position tracking. The same discipline pension funds expect, now feeding blockchain rails.

Midas: The Tokenization Platform

Dennis Dinkelmeyer, Fabrice Grinda, and Romain Bourgois founded Midas to build financial infrastructure for the internet era. The mission: institutional-grade financial products through blockchain-based architecture, maintaining the rigor and compliance traditional finance demands.

Dennis Dinkelmeyer (Co-Founder & CEO) held investment roles at Capital Group and Goldman Sachs, with significant experience investing in and advising technology companies from early-stage to public markets. He holds a BSc in Economics from University College London.

Fabrice Grinda (Co-Founder & Executive Chairman) is the Founding Partner of FJ Labs and among the world's leading marketplace entrepreneurs and investors with over 300 exits on over 1,000 angel investments. Forbes named him the number one angel investor in the world in 2018 based on publicly recorded investments and exits.

Romain Bourgois (Co-Founder & CPO) served as Head of Product at Ondo Finance, launching tokenized real-world asset products including OUSG, Flux Finance, and USDY. He brings nine years of product leadership experience from Criteo.

Backed by Framework Ventures, BlockTower, Coinbase Ventures, GSR, and others, Midas handles what tokenization platforms must: compliance frameworks, regulatory structuring, investor rights, custody arrangements. They ensure mF-ONE meets European and global regulatory standards.

EO Network: The Data Infrastructure

We provide verified NAV feeds for complex vault strategies. Independent calculation, multi-party verification, on-chain delivery with cryptographic proofs. When vault tokens need to work as DeFi collateral, protocols must trust the valuation. EO Network supplies that trust layer.

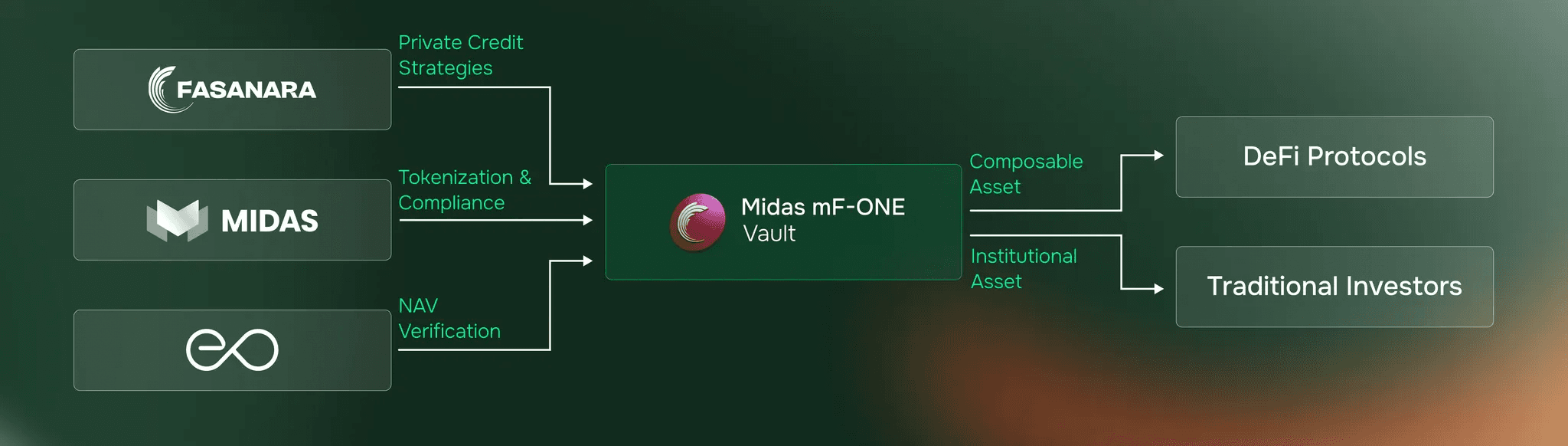

The model works because each party focuses on their expertise. Fasanara manages assets. Midas handles tokenization and compliance. EO Network verifies the data. The result: composable institutional DeFi.

III. The RWA Data Challenge: Why Private Credit NAV Is Complex

Generic oracles price what trades. Private credit doesn't trade on exchanges. The challenge: valuing off-chain assets for on-chain use.

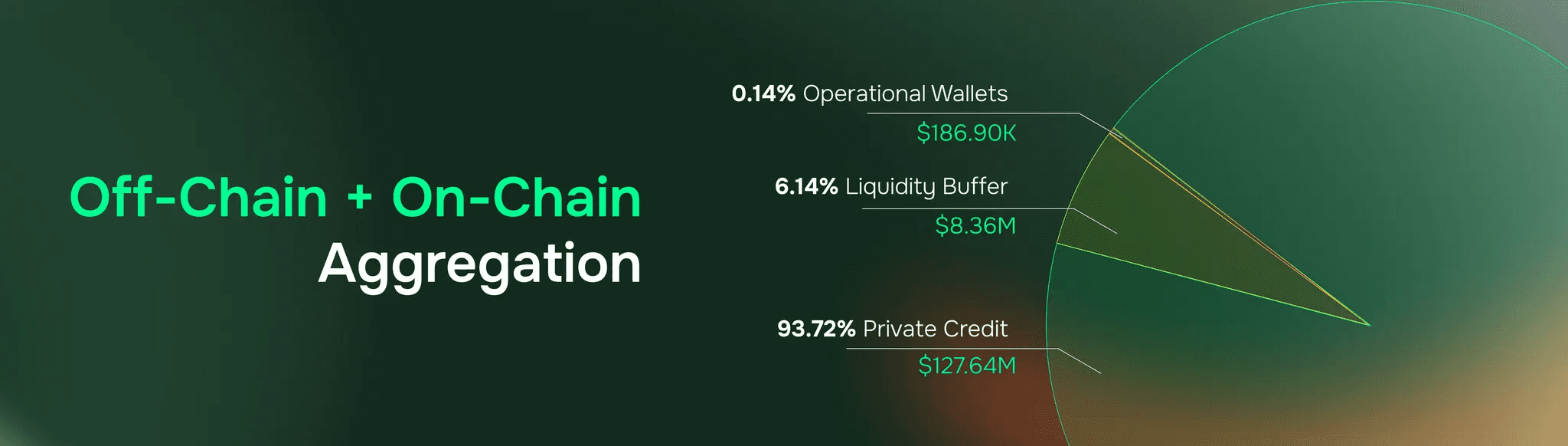

Off-Chain + On-Chain Aggregation

mF-ONE holds three types of positions (as of January 5, 2026):

93.72% Fasanara private credit (off-chain): $127.64M

6.14% instant liquidity buffer (on-chain USDC): $8.36M

0.14% operational wallets: $186.90K

A single NAV calculation must value and aggregate both worlds. The private credit lives in traditional fund structures. The liquidity sits in blockchain wallets and DeFi protocols. Both must reconcile to one verifiable number.

Why This Takes Time

Private credit positions don't have market prices. They require daily audit reports from Fasanara following institutional fund accounting standards. If errors surface during verification, the entire recalculation starts over. This isn't a bug; it's institutional rigor.

Business-day cadence follows traditional finance standards, not 24/7 crypto time. Off-chain asset valuation takes hours. Manual verification ensures accuracy. Then on-chain position tracking must align with those valuations.

Multiple Data Source Coordination

Every NAV calculation pulls from:

Off-chain: Fasanara audit reports (signed, auditable, verifiable)

On-chain: Direct blockchain queries for wallet balances and protocol positions

Protocol integration data: Morpho market statistics for lending activity

Reconciliation layer: All sources must verify against each other

Generic price oracles weren't built for this. You can't aggregate Chainlink feeds and call it RWA infrastructure. You need specialized systems that handle institutional reporting cycles, verify off-chain valuations, and publish trustworthy data on-chain.

IV. EO Network's Solution: Purpose-Built RWA Infrastructure

We built infrastructure specifically for complex vault strategies where assets live both on-chain and off-chain. Here's how it works.

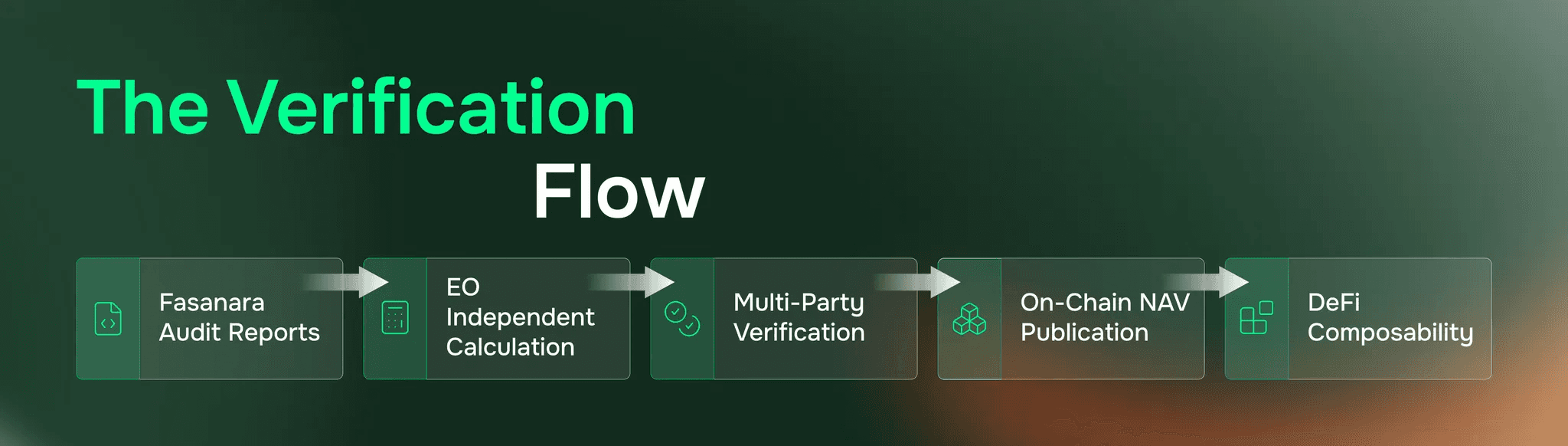

The Verification Flow

Step 1: Daily audit reports. Fasanara provides private credit position valuations following institutional fund accounting standards.

Step 2: Independent recalculation. EO Network doesn't blindly trust reported values. We recompute NAV from all data sources, both off-chain reports and on-chain positions.

Step 3: Multi-party verification. All parties verify accuracy before anything publishes. Fasanara, Midas, and EO Network must agree the numbers reconcile.

Step 4: On-chain delivery. Verified NAV publishes with cryptographic proofs. Other protocols can read this value trustlessly.

Infrastructure Components

Data aggregation pulls from multiple sources:

On-chain: Direct RPC queries (no intermediary APIs for blockchain data)

Off-chain: Signed, auditable reports from Fasanara

Protocol APIs: Morpho integration data for lending markets

Everything feeds into unified NAV calculation that accounts for all positions.

Validation automation runs continuous checks:

Automated reconciliation (all numbers must add up)

Block number verification (confirms data freshness)

Price deviation safeguards (anomaly detection)

Circuit breakers for outlier protection

Modular architecture adapts to strategy changes. Our vault-agnostic platform can add or remove assets, adjust calculation weights, and change data sources. When Fasanara adjusts the private credit portfolio, NAV infrastructure adapts automatically. All changes execute in verifiable, secure manner.

This enables:

Auditable calculation logs (accounting trail for institutional investors)

Real-time transparency (positions visible, not black box)

Composability (other protocols trust the NAV for collateral acceptance)

Complex RWA positions get the same composability as native DeFi assets.

V. Results: Institutional Private Credit, DeFi Composability

The infrastructure works. The numbers prove it.

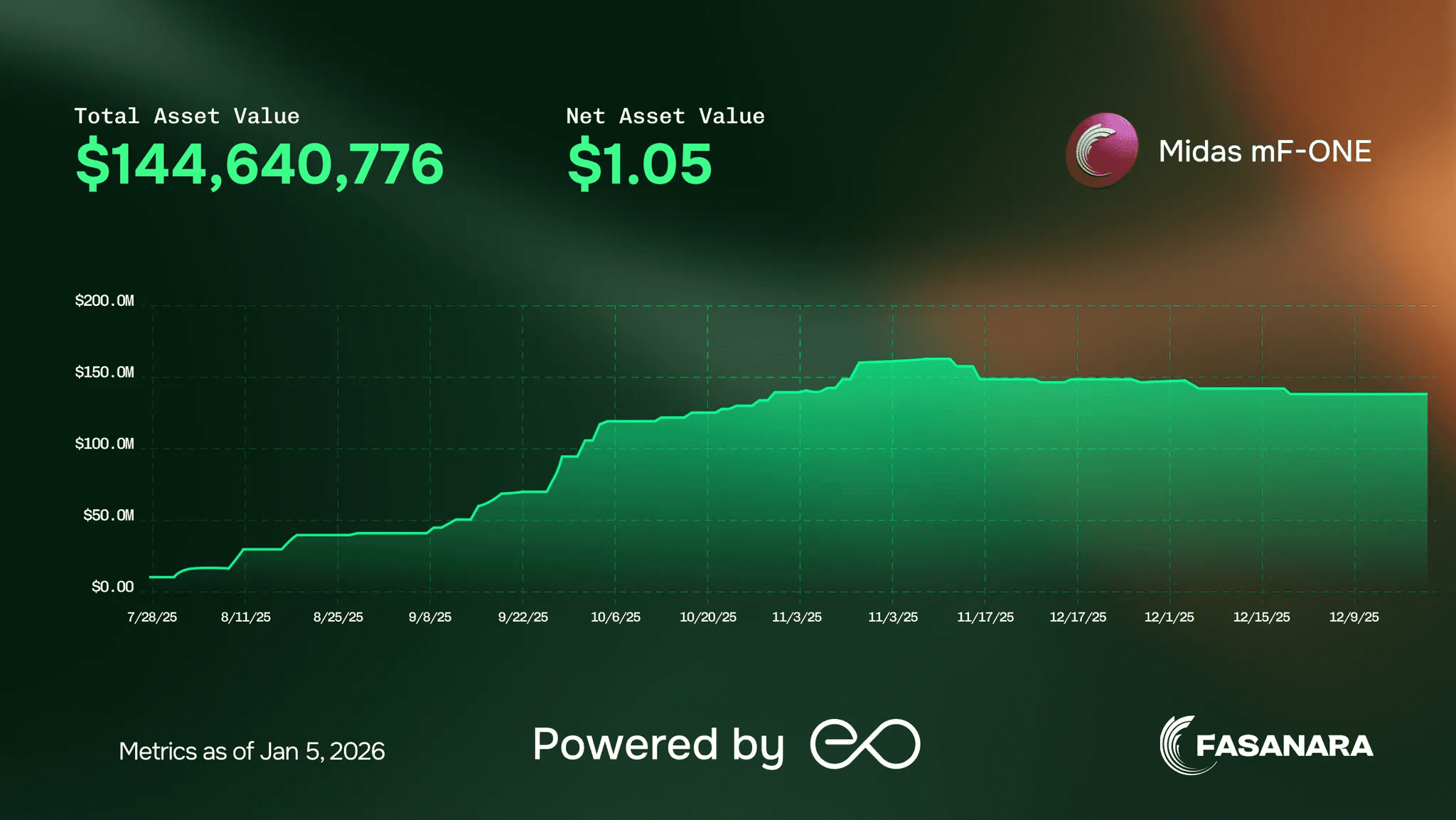

Current Performance (January 5, 2026)

Total Value Locked: $144.64M

Token Price: $1.0457

Annual Percentage Yield: 6.17%

Instant Liquidity Buffer: $8.36M

Price Updates: Several times per week

Morpho Lending Integration

Real composability means mF-ONE tokens work as collateral in DeFi lending markets. Morpho integration demonstrates this:

Total Market Size: $36.69M

Available Liquidity: $5.23M

Average Borrow Rate: 6.47%

Lending protocols accept mF-ONE as collateral with confidence because they can verify NAV independently. No trust assumptions required.

[Graphic: Morpho integration stats card showing "Market Size: $36.69M" | "Available Liquidity: $5.23M" | "Avg Borrow Rate: 6.47%"]

Transparency in Practice

Asset breakdown fully visible: 93.72% private credit, 6.14% liquidity buffer, 0.14% operational wallets. All positions verifiable by any party. Protected by Fordefi custody infrastructure. Fully transferable tokens with no restrictions post-eligibility.

Dennis Dinkelmeyer, CEO of Midas:

"EO is a team that truly delivers. From our experience collaborating on mF-ONE, our first tokenized private credit asset, we trusted them because they are proactive, fast, and laser-focused. When building at the frontier of innovation, you want a partner like EO by your side."

What verified NAV unlocked:

Lending protocols safely accept mF-ONE as collateral

Institutional investors have auditable trail

Private credit strategies compose with DeFi primitives

Capital efficiency without sacrificing institutional standards

VI. What This Proves

Complex RWA strategies can achieve full DeFi composability. The missing piece was verification infrastructure.

The Template for Institutional RWA

This partnership model scales:

Asset manager provides institutional-grade reporting (Fasanara)

Tokenization platform handles compliance and structuring (Midas)

Data infrastructure provides independent verification (EO Network)

The result: composable, institutional-grade DeFi assets at scale.

Where This Is Heading

More private credit vaults will follow this model. Other RWA categories (real estate, structured credit, trade finance) need similar infrastructure. Institutional capital flows into DeFi when proper verification exists. Data infrastructure becomes the enabling layer for TradFi-DeFi convergence.

The EO Network role: We built purpose-built infrastructure for this frontier. When assets live off-chain, when strategies are complex, when institutional standards matter, specialized data infrastructure is non-negotiable.

Explore mF-ONE: https://midas.app/mfone

Learn more about EO Network's RWA infrastructure: docs.eo.app