By

Ron B.

Jan 7, 2026

RWA Adoption

The NAV Trust Problem

NAV stands for Net Asset Value. The formula is straightforward:

Total Assets / Total Supply = NAV per share

This NAV per share is the price of your vault tokens. As the vault's strategy earns yield, NAV increases. Your shares become worth more. Simple enough.

The problem isn't the math. It's trust.

Most vaults calculate their own NAV. The vault operator reports "we're worth $X" and everyone just... believes them. No independent verification. No cryptographic proof. No recourse if they're wrong.

This creates real consequences. Lending protocols won't accept unverified vault tokens as collateral—too risky. Institutional investors require audited valuations before deploying capital. Vault tokens stay isolated rather than composable. The self-reporting model creates a composability ceiling.

Consider the spectrum of complexity. Yield-bearing vaults track positions across DeFi protocols—lending, staking, liquidity provision. Meta-vaults aggregate multiple underlying vaults, like a fund-of-funds. RWA vaults hold tokenized real-world assets requiring off-chain valuations bridged to on-chain verification.

Each strategy needs trusted NAV data. But if you solve verification for RWA—the hardest case—you've built infrastructure that handles any vault strategy.

So what makes RWA vaults the verification frontier?

Why RWA Vaults Are the Verification Frontier

The convergence of traditional finance and DeFi isn't just about moving assets onchain. It's about moving them with the trust standards institutions require.

Traditional finance NAV reporting is audited, verified by independent parties, and follows established accounting frameworks. Crypto needs something equivalent. But blockchain verification isn't the same as traditional audit processes. The challenge: How do you verify off-chain asset values onchain?

RWA vaults face three complexity layers:

Off-chain asset valuation. Private credit, real estate, and treasuries don't have "market prices" in the traditional sense. They require manual evaluation from asset managers. Calculation is a manual process, not blockchain seconds. It can take hours or days. If errors are found, you start over from scratch.

Multi-source reconciliation. RWA vaults hold both off-chain positions (reported by asset managers) and on-chain positions (deployed in DeFi protocols). Both must aggregate into a single verified NAV. This isn't just adding numbers—it's reconciling two different financial systems with different settlement cycles and data formats.

Institutional verification requirements. Institutions don't operate on trust assumptions. They need independently calculated NAV, not self-attested values. They need auditable trails for compliance. They need multi-party verification models that eliminate single points of trust.

The timing mismatch compounds everything. Traditional finance moves on business-day cycles with T+2 settlement. Blockchain operates 24/7 with sub-second finality. Both need to coexist without compromising trust.

Take Midas mF-ONE. It holds $144.64M in tokenized Fasanara private credit. Without verified NAV, this capital stays isolated. With it, mF-ONE unlocked a $36.69M market size on Morpho lending markets. The difference between isolation and composability is verification infrastructure.

This isn't about making TradFi faster. It's about building verification infrastructure that meets institutional standards while enabling DeFi composability. If infrastructure can verify complex RWA vaults, it can handle simpler strategies. This is the hard problem worth solving.

How Institutional-Grade NAV Infrastructure Works

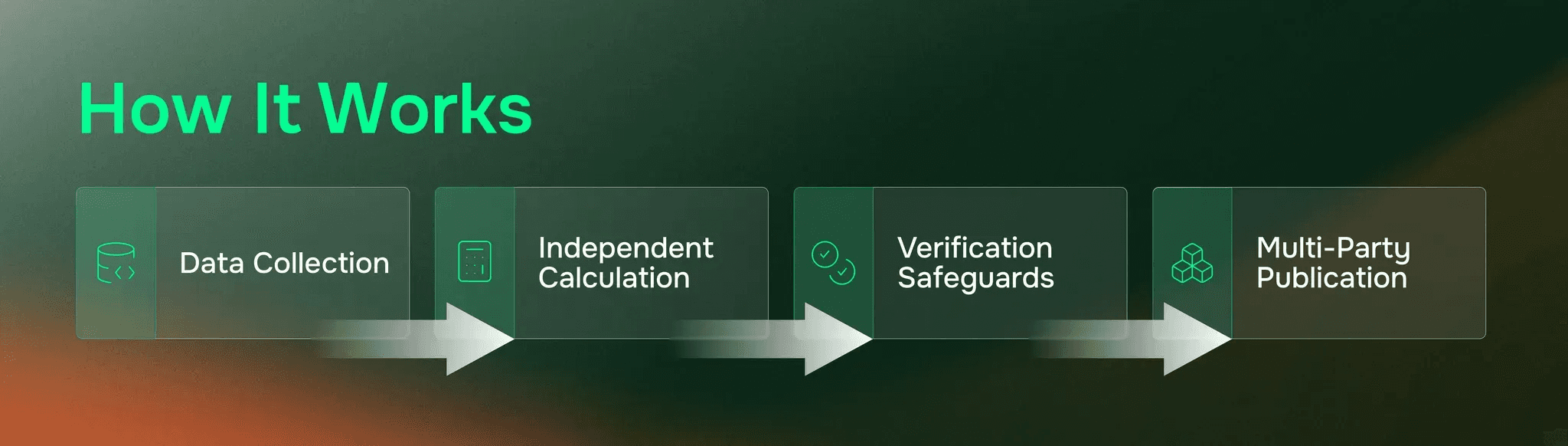

Purpose-built NAV infrastructure operates on a core principle: independent recalculation, not blind trust.

Institutional-grade verification encompasses four foundational elements:

Source-level data integrity. For on-chain positions, fetch data directly from blockchain state—no intermediary APIs that introduce additional trust assumptions. For off-chain positions, require signed, auditable reports from asset managers. When protocols expose native integrations, use them for direct verification.

Independent calculation. Recalculate NAV from source data rather than accepting reported values at face value. Follow strategy-specific methodology defined with risk managers. Apply automated validation processes that reduce manual verification time while maintaining accuracy.

Multi-layer safeguards. Price deviation checks flag anomalies before publication. Block verification ensures calculations match current state. Circuit breakers pause operations if deviation thresholds are exceeded. Fallback mechanisms provide agreed-upon pricing methods for edge cases like network issues.

Multi-party verification. A three-party model involving oracle provider, tokenization platform, and asset manager ensures no single point of failure. One party initiates the NAV update, others verify before on-chain publication.

The infrastructure must adapt as strategies evolve. Vaults change allocations, add new assets, integrate new protocols, and adjust strategy weights. Purpose-built architecture supports these changes through modular design—add or remove data sources, modify calculation methodologies, integrate new positions, all in verifiable and secure ways.

Operational cadence follows institutional standards. RWA vaults update on business-day cycles, aligned with traditional finance reporting. The infrastructure also maintains capacity for protective updates—emergency NAV recalculation during sudden market changes to protect vault holders.

Beyond data delivery, institutional infrastructure provides calculation logs for auditors (creating an audit trail), real-time dashboards for transparency, and automated validation that accelerates traditionally manual processes.

The difference between generic price feeds and purpose-built vault infrastructure is scope. Generic oracles provide spot token prices. Vault infrastructure handles yield accrual accounting, multi-protocol position tracking, off-chain asset integration, and strategy-specific valuation methodologies.

This is what makes the verification gap closable.

Real-World Implementation: mF-ONE Private Credit Vault

Theory meets practice in Midas mF-ONE, a vault tracking Fasanara yield strategies backed by tokenized private credit and on-chain liquidity. It's one of DeFi's first institutional-grade RWA implementations operating at scale.

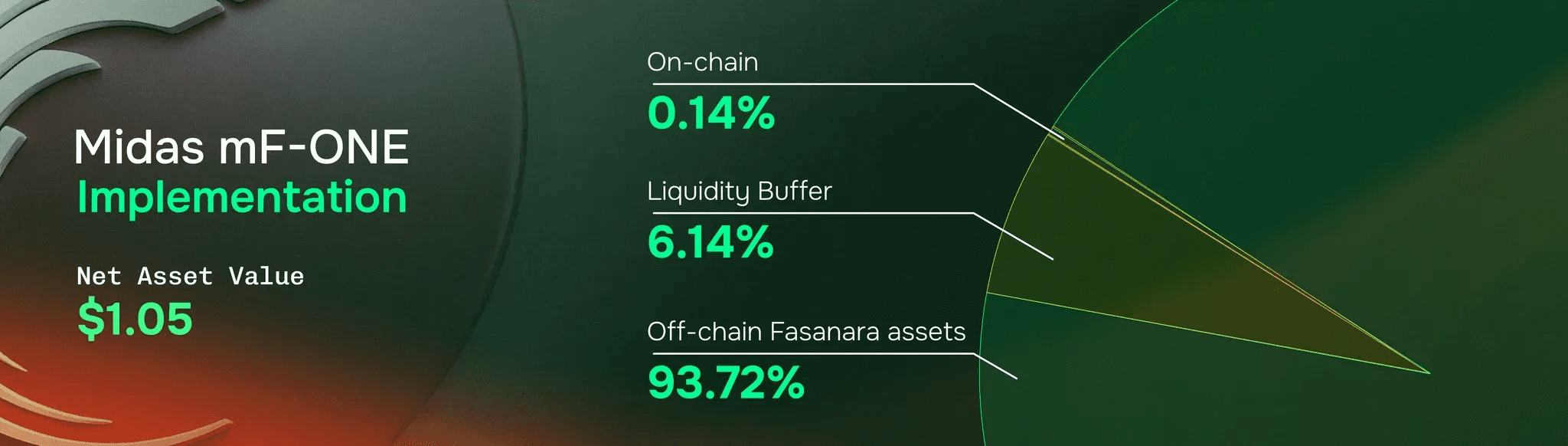

Current metrics (January 4, 2026):

TVL: $144.64M

Token price: $1.0457

APY: 6.17%

Instant liquidity buffer: $8.36M available for immediate redemptions

The verification process operates daily. Fasanara provides audit reports on private credit positions following traditional finance standards. The NAV infrastructure independently recalculates valuation from both off-chain assets and on-chain positions. Multi-party verification confirms accuracy before on-chain publication. Updates follow business-day cadence, aligned with institutional reporting cycles.

This transparency extends to asset allocation. The vault maintains 93.72% in off-chain Fasanara assets ($127.64M), 6.14% in liquidity buffer ($8.36M), and 0.14% in on-chain wallets ($186.90K). Price updates occur several times per week. Assets are protected by Fordefi custody. The structure is fully transferable to qualified investors.

Verified NAV unlocked composability. The vault integrated with Morpho lending markets, achieving $36.69M in total market size with $5.23M in available liquidity. Average borrow rate as of January 4, 2026 (7:15AM PST) was 6.47%. Vault tokens function as collateral with confidence. Institutional investors access auditable NAV trails for compliance.

Dennis Dinkelmeyer, CEO, Midas: "EO is a team that truly delivers. From our experience collaborating on mF-ONE—our first tokenized private credit asset—we trusted them because they are proactive, fast, and laser-focused. When building at the frontier of innovation, you want a partner like EO by your side."

This implementation proves complex RWA strategies can achieve DeFi composability. The missing piece was verification infrastructure bridging traditional finance standards with blockchain transparency.

The blueprint exists: Tokenization platform (Midas) + Asset manager (Fasanara) + Verification infrastructure (EO Network). This model extends beyond private credit to any RWA requiring institutional-grade verification.

NAV Across All Vault Strategies

RWA represents the hardest verification challenge. The same infrastructure principles serve all vault strategies, adapted to complexity level.

Yield-bearing strategies track positions across lending protocols, staking platforms, and liquidity provision venues. The infrastructure handles both rebasing token accounting (where token balances increase as yield accrues) and non-rebasing tokens (where exchange rates increase instead). Updates occur as frequently as yield accumulates and positions change.

Diversification strategies, often called meta-vaults, aggregate NAV across multiple underlying vaults. Composite calculation pulls from each component vault's verified feed. These strategies inherit risk from all underlying positions, making independent verification critical rather than accepting each component's self-reported value.

RWA strategies bridge off-chain asset valuations with on-chain positions. They require multi-party verification models, auditable calculation trails, and business-day update cadence aligned with traditional finance reporting. mF-ONE demonstrates this approach at $144M scale.

The common thread: Same product (NAV feeds), different complexity. Purpose-built infrastructure adapts across the spectrum. Simple strategies receive real-time block-level updates. Complex strategies get daily verification with institutional safeguards. Any strategy updates as frequently as the vault's allocation changes.

Generic oracles can't handle this range. They're designed for spot token prices—single assets trading on liquid markets. They don't understand vault share valuation with yield accrual, multi-asset positions, strategy-specific accounting rules, or off-chain component integration.

Verification infrastructure designed for institutional vaults handles these requirements natively.

What Verified NAV Enables for Different Stakeholders

Verified NAV infrastructure unlocks different value for each ecosystem participant.

For vault creators and builders: Purpose-built infrastructure adapts to strategy complexity. The architecture encompasses calculation, verification, and reporting capabilities. Modular design allows infrastructure to evolve alongside vault strategy. Focus remains on strategy design and execution while verification infrastructure handles the trust layer.

For risk managers and curators: Independent verification provides the foundation for setting safe parameters. Automated validation accelerates traditionally manual processes. Multi-party confirmation models eliminate single points of trust. Verification infrastructure enables the institutional-grade vault products curators design.

For institutional investors: Auditable calculation trails meet compliance requirements. Transparent methodology and data sources provide visibility into valuation processes. Multi-party verification removes dependence on any single entity's claims. The transparency required for institutional capital deployment becomes accessible.

For DeFi protocols: Verified NAV data enables safely accepting vault tokens as collateral. Liquidation parameters can be set confidently based on independently calculated valuations. Multiple strategies become available to users without requiring protocol-level trust assumptions about individual vaults. Composability expands the strategy universe available to protocol users.

The convergence realized: RWA vaults with institutional verification standards. Business-day TradFi cycles coexisting with 24/7 DeFi operations. Traditional audit processes combined with on-chain transparency. Capital efficiency of DeFi meeting trust standards of TradFi.

This convergence doesn't happen with technology alone. It requires infrastructure purpose-built to bridge these systems while maintaining the standards both require.

Conclusion

Everyone talks about tokenizing real-world assets. Few talk about verifying their value onchain. This verification infrastructure gap kept RWA capital isolated—tokenized but not composable.

NAV feeds close that gap. They transform self-reported valuations into independently verified, institutional-grade data. For RWA strategies holding complex off-chain positions, multi-party verification meets the trust requirements institutional capital demands.

Real implementation at scale validates the approach. Midas mF-ONE operates at $144.64M TVL with $36.69M in Morpho market size. Business-day verification cycles coexist with DeFi composability. Tokenized private credit functions as collateral across lending markets. The infrastructure that makes this possible extends across all vault strategies—from simple yield-bearing to complex RWA.

As more institutional capital moves onchain, the vaults that succeed will have verification infrastructure bridging TradFi standards with DeFi composability. The missing piece isn't the assets themselves. It's the trust layer that makes them usable.

The infrastructure exists. The blueprint is proven. The verification gap is closable.

Explore EO Network's NAV feed infrastructure: docs.eo.app