By

John Broadley

Oct 21, 2025

Education

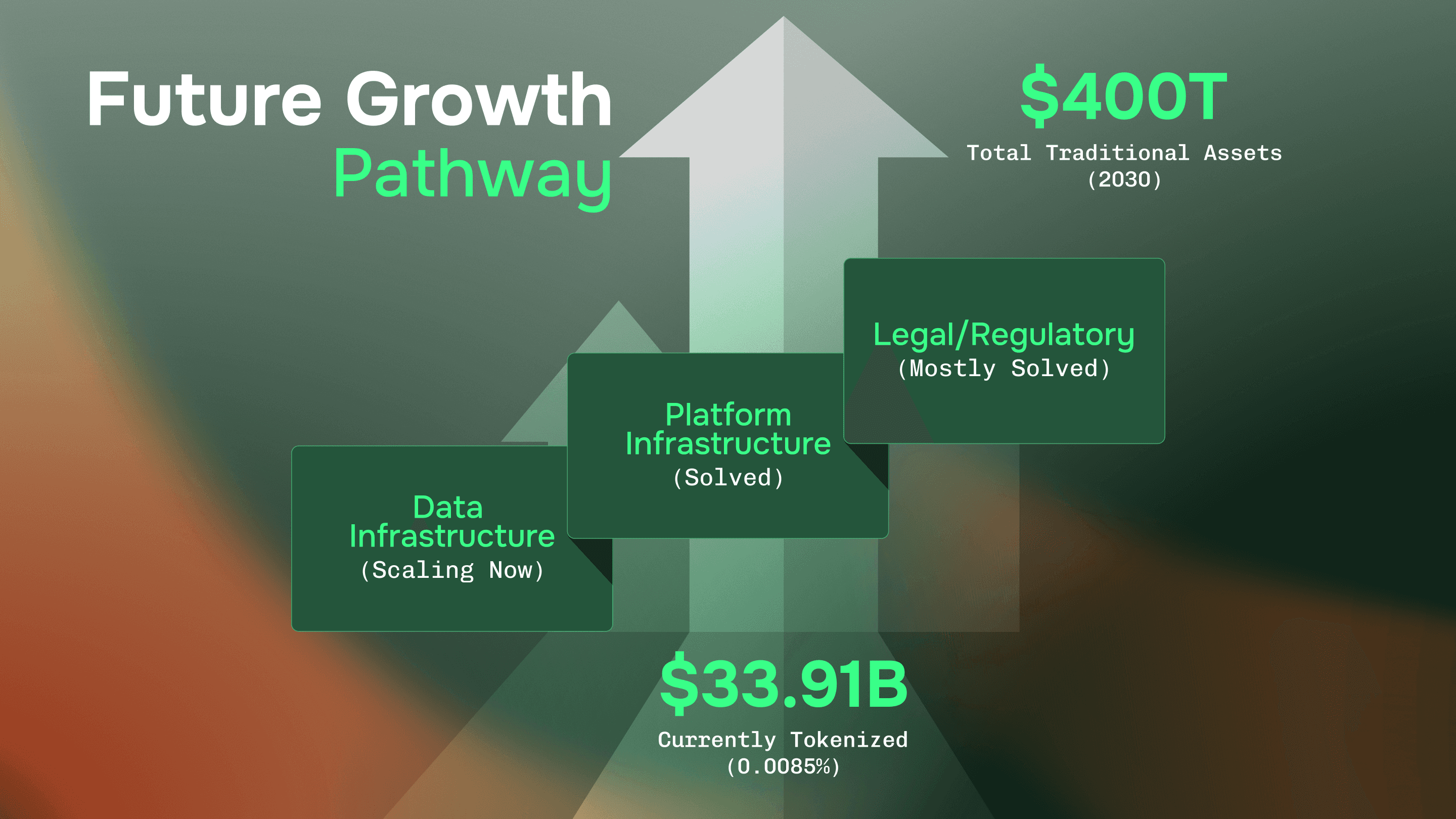

Introduction: The $400 Trillion Opportunity

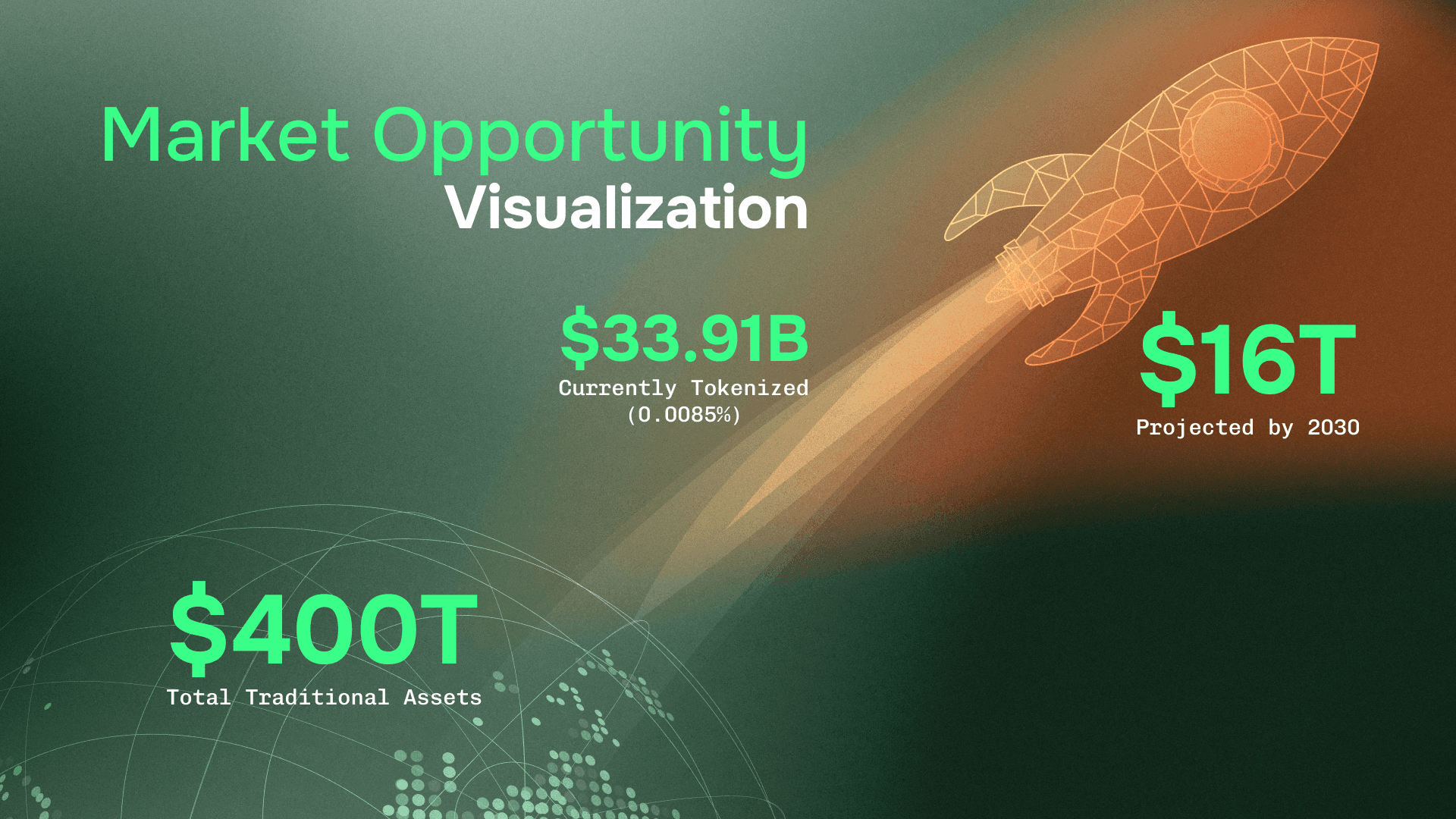

The financial industry stands at a critical inflection point. According to recent analysis from Animoca Brands Research and industry reports, approximately $400 trillion in traditional financial assets like stocks, bonds, real estate, commodities exist globally. Yet as of October 16, 2025, only $33.91 billion have moved on-chain, representing a mere 0.0085% penetration rate.

This isn't speculative DeFi territory. Major institutions from BlackRock to Fasanara Capital are deploying tokenized funds as production infrastructure serving real capital. Industry projections forecast the tokenized asset market reaching $16 trillion by 2030. It’s a 47,000% growth trajectory that represents one of the most significant infrastructure transitions in modern finance.

Yet a critical question remains: What must happen to bridge this massive gap between current adoption and projected growth? The answer isn't blockchain technology itself. It's the specialized infrastructure layer that transforms tokenized assets from static digital certificates into trusted, verifiable, and composable financial instruments.

This guide explains how tokenization actually works in practice, what requirements determine successful implementation, and why data infrastructure has emerged as the critical enabler of institutional adoption.

Part 1: Understanding Tokenization

What Tokenization Actually Means

Tokenization is the process of creating blockchain-based representations of traditional financial assets. Transforming securities, credit instruments, real estate, and commodities into digital tokens with programmable properties and transparent verification.

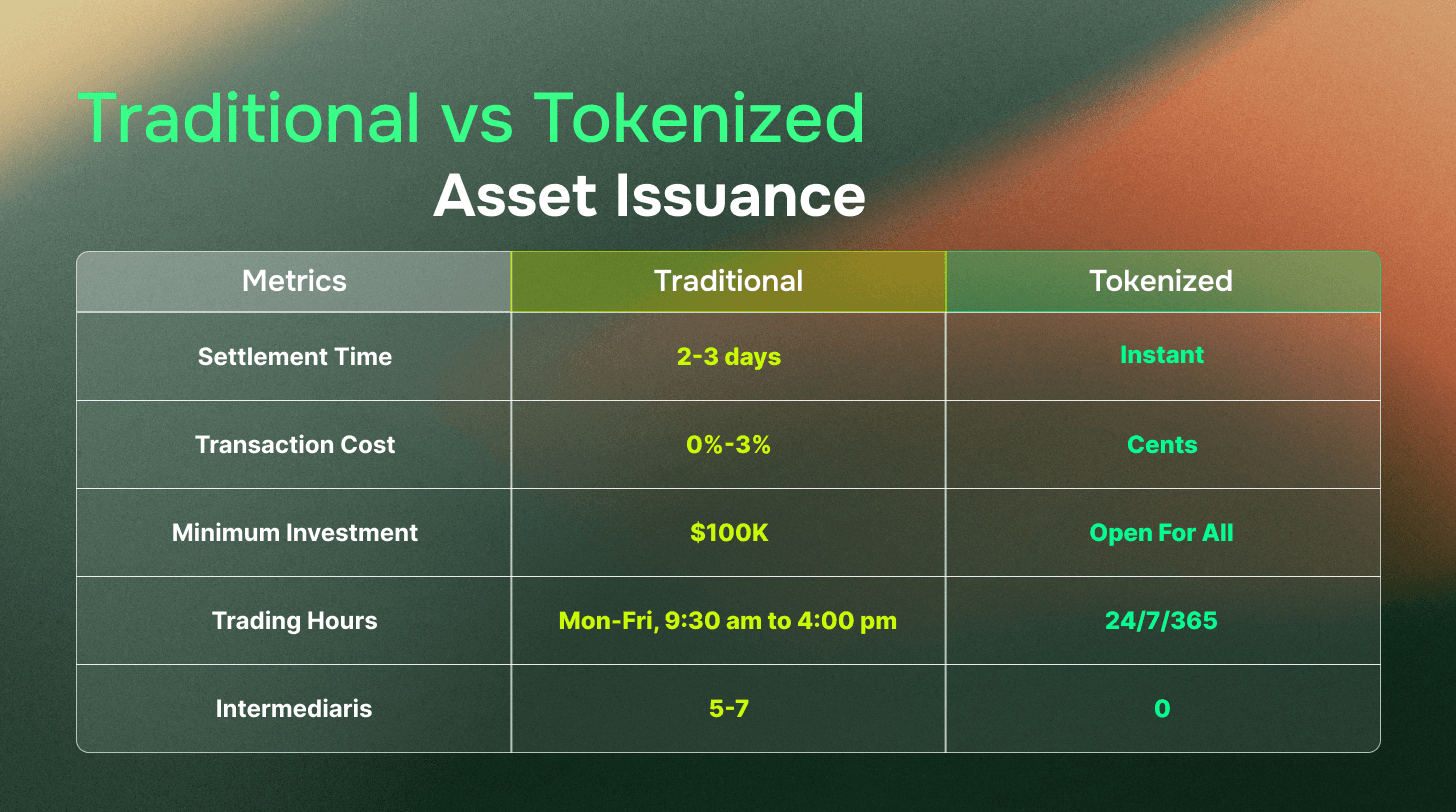

Unlike simple digitization (recording ownership in databases), tokenization creates native blockchain assets with embedded logic, cryptographic security, and interoperability across financial protocols. These tokens represent legal claims on underlying assets while enabling functionality impossible in traditional markets: 24/7 settlement, fractional ownership, instant transfers, and programmable compliance.

Asset Classes Being Tokenized

Private Credit: Institutional credit portfolios previously restricted to qualified investors are becoming accessible through tokenized funds, enabling new models for on-chain credit that combine institutional rigor with DeFi efficiency. Fasanara Capital's mF-ONE fund, currently managing $147.3 million in assets, exemplifies how European SME credit can be tokenized with institutional-grade transparency.

Treasuries and Fixed Income: U.S. Treasury exposure is being packaged into on-chain instruments, providing stable, yield-bearing assets for digital capital deployment. BlackRock's BUIDL fund represents major institutional validation of this approach.

Real Estate: Commercial and residential properties are being fractionalized into tokens, reducing entry barriers from millions to thousands while enabling secondary market liquidity for traditionally illiquid assets.

Commodities: Physical assets like gold and carbon credits gain on-chain representation with cryptographic proof-of-reserve verification and instant transferability.

Why Tokenization Matters for Traditional Finance

The operational benefits are structural, not marginal:

Cost Reduction: Traditional asset issuance involves layers of intermediaries, such as transfer agents ($50-200K annually), custodians (20-50 bps of AUM), clearing houses, and compliance administrators. Tokenization replaces intermediary coordination with programmatic execution via smart contracts, reducing costs by 60-80% for fund administration.

Operational Efficiency: Settlement occurs instantly rather than T+2 or longer. Corporate actions (distributions, redemptions, voting) execute automatically based on on-chain logic. Compliance requirements (KYC/AML, accreditation verification, transfer restrictions) are enforced programmatically.

Expanded Distribution: Fractional ownership dramatically lowers minimum investments. A commercial real estate asset requiring $1M minimum in traditional structures can be fractionalized into $10K tokens, expanding the investor base by orders of magnitude while maintaining the same regulatory compliance framework.

Enhanced Liquidity: Tokenized assets can trade continuously on secondary markets with transparent pricing and instant settlement. It’s a fundamental improvement for traditionally illiquid asset classes like private credit or real estate.

Part 2: How Tokenization Works in Practice

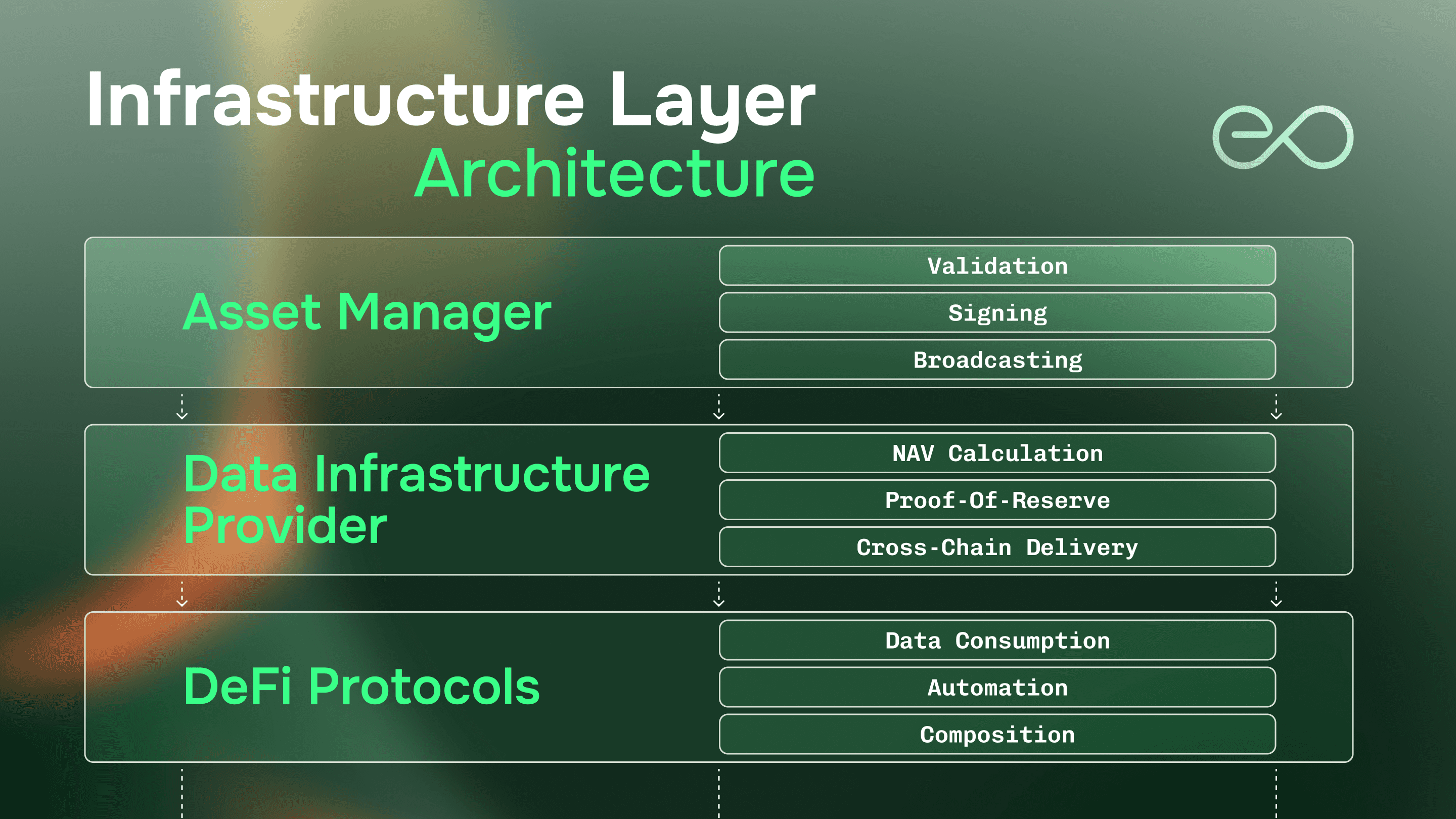

Successful tokenization requires orchestrating three specialized layers, each contributing essential functionality. Understanding this architecture is critical for evaluating platforms and assessing tokenized assets.

The Three-Layer Tokenization Stack

Layer 1: Asset Managers

Firms like Fasanara Capital or BlackRock manage the underlying financial assets: private credit portfolios, Treasury securities, or real estate holdings. Their responsibilities include:

Maintaining asset quality and executing investment strategy

Ensuring legal compliance with traditional securities regulations

Calculating portfolio valuations and performance metrics

Providing transparent reporting to investors and regulators

Layer 2: Tokenization Platforms

Platforms like Midas, Securitize, or Centrifuge provide the legal structuring, technical issuance infrastructure, and lifecycle management:

Legal entity formation (SPVs, trusts) that hold underlying assets

Regulatory compliance frameworks (KYC/AML, accreditation verification)

Smart contract deployment with embedded compliance logic

Token distribution and investor administration

Corporate action execution (distributions, redemptions, voting)

Layer 3: Data Infrastructure Providers

This critical layer provides the verification infrastructure that makes tokens trusted and usable. Specialized providers like EO Network deliver:

Real-time asset valuation (NAV feeds for funds, appraisals for real estate)

Proof-of-reserve verification with cryptographic attestation

Performance data broadcasting across multiple blockchains

Risk-aware pricing methodologies for complex assets

Without this infrastructure layer, tokenized assets remain opaque wrappers unable to integrate with lending protocols, automated strategies, or institutional risk management systems.

The Tokenization Implementation Process

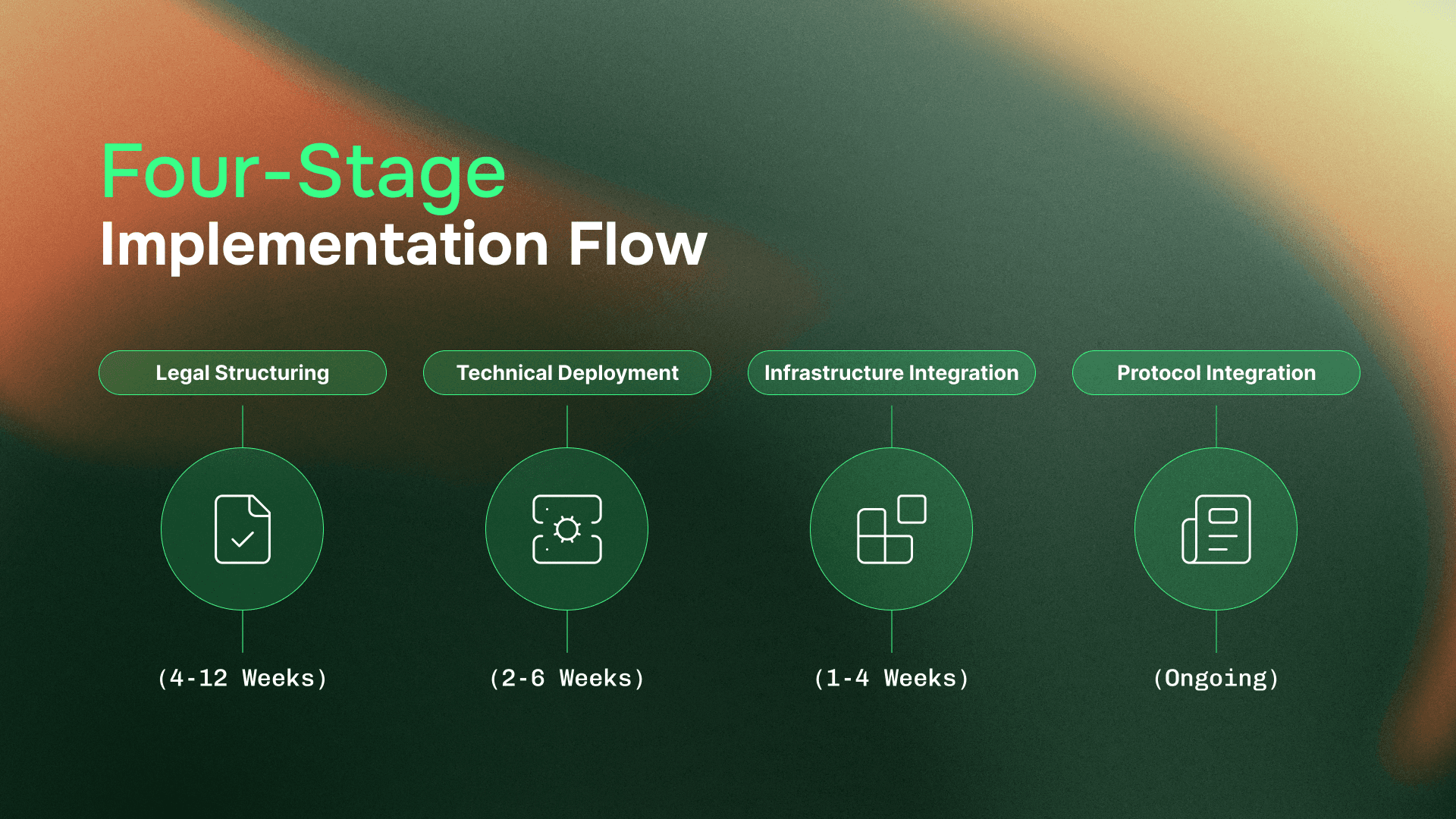

Stage 1: Legal Structuring (4-12 weeks)

Asset managers collaborate with tokenization platforms to establish compliant legal frameworks:

Asset custody arrangements and third-party verification protocols

Token legal classification (security token vs. other structures)

Jurisdictional compliance strategy appropriate to target markets and regulatory requirements

Investor eligibility frameworks and transfer restrictions

Stage 2: Technical Deployment (2-6 weeks)

Smart contract implementation with programmatic compliance:

Transfer restrictions encoded in contract logic (accredited investors, lock-up periods)

Corporate action automation (distributions, redemptions based on token holdings)

Multi-chain deployment strategy for broad protocol compatibility

Integration with custody and compliance infrastructure

Stage 3: Infrastructure Integration (1-4 weeks)

Connecting data infrastructure for real-time verification. For fund tokens, this means:

NAV calculation methodology (daily, weekly, or monthly updates)

Data validation and cryptographic signing mechanisms

Cross-chain broadcasting for multi-network accessibility

Proof-of-reserve attestation frameworks

This stage determines whether tokens become composable instruments or remain static certificates. Generic price feed solutions often fail here because tokenized assets require domain-specific aggregation logic. For example, private credit NAV calculations differ fundamentally from exchange-traded asset pricing, requiring specialized infrastructure that understands institutional credit metrics.

Stage 4: Protocol Integration (Ongoing)

With trusted data infrastructure established, tokenized assets can be:

Listed as collateral in lending protocols (enabling borrowing without redemption) - As demonstrated by mF-ONE's integration with Morpho, where investors borrow stablecoins against private credit positions while maintaining yield exposure

Integrated into automated portfolio strategies and yield optimization vaults - Like Upshift's tokenized vault strategies that transform yield-bearing receipts into composable DeFi primitives

Composed with other DeFi primitives for sophisticated institutional strategies - Including f(x) Protocol's innovative yield strategies on Morpho that leverage multiple tokenized assets

Utilized in risk-managed institutional products - Such as Silo's lending markets with curated risk parameters and programmatic collateral management

Part 3: Value Propositions Across Stakeholders

For Asset Issuers: Efficiency and Expanded Access

Asset managers evaluating tokenization gain concrete operational advantages:

Structural Cost Reduction: Eliminating transfer agents, reducing custodian fees, and automating compliance administration saves $500K-1M annually for a $100M fund. Smart contracts replace manual intermediary coordination with programmatic execution.

Global Distribution: Tokenized assets enable worldwide investor access with programmatic compliance enforcement. Instead of relying on broker-dealer networks taking 2-7% placement fees, distribution occurs through on-chain channels with automated accreditation verification.

Improved Liquidity Profile: Secondary market trading with instant settlement enhances asset attractiveness. Investors no longer face quarterly redemption windows or broker-mediated exits at steep discounts. This liquidity premium attracts deeper capital pools.

New Utility Models: Perhaps most transformatively, tokenization enables composability. Investors can borrow against tokenized fund positions in lending protocols, maintaining exposure while accessing liquidity through institutional-grade money markets. Automated strategies can programmatically rebalance across multiple tokenized instruments. These capabilities create network effects. Enhanced utility increases demand, deeper liquidity improves pricing, and better infrastructure attracts more institutional participation.

For Investors: Access and Transparency

Institutional and qualified investors gain material advantages:

Democratized Access: Fractional ownership opens previously restricted asset classes. Investors with $25K can access institutional-grade private credit portfolios or diversified real estate holdings that traditionally required $250K-$1M minimums.

Precision Allocation: Portfolio managers achieve exact target allocations (e.g., 7.3% in tokenized private credit) rather than being constrained by fund minimums that force over- or under-allocation.

Operational Liquidity: Secondary markets enable continuous trading with transparent pricing and instant settlement. When liquidity is needed, execution occurs in seconds rather than months, which is critical for dynamic portfolio management.

Real-Time Transparency: Instead of quarterly reports with 30-45 day lags, tokenized assets enable continuous verification:

Daily or intraday NAV updates broadcast on-chain

Cryptographic proof-of-reserve verification

Historical performance data permanently recorded

Independent infrastructure providing validation (not just manager-reported data)

This transparency fundamentally transforms due diligence and ongoing monitoring for institutional allocators, creating the foundation for institutional DeFi where verification replaces trust.

Risk Management Capabilities: Smart contracts enable sophisticated programmatic risk controls:

Automated rebalancing based on verified real-time valuations

Circuit breakers triggering redemptions during market stress

Collateral management systems adjusting loan-to-value ratios as asset values change

These capabilities depend entirely on infrastructure quality. Automated systems require manipulation-resistant data with clear provenance. The type of specialized infrastructure EO Network deliver.

Part 4: The Critical Infrastructure Layer

Why Infrastructure Determines Success

Most tokenization discussions focus on issuance technology: smart contract capabilities, multi-chain deployment, compliance logic. These are necessary but insufficient. The critical constraint determining whether tokenized assets achieve meaningful adoption is data infrastructure.

Consider the essential questions any protocol must answer before accepting a tokenized asset:

What is this asset worth right now?

How do I verify that valuation independently?

What assets back this token?

Has portfolio performance changed materially?

Traditional fund structures answer these questions through quarterly reports and third-party audits, which is acceptable for passive holders but inadequate for active utilization. Lending protocols can't wait 45 days for NAV updates before adjusting collateral requirements. Automated strategies can't rebalance based on quarterly-lagged data.

The Data Verification Bottleneck

Here's the fundamental challenge: tokenized assets require complex, domain-specific valuations that differ fundamentally from simple exchange prices.

Private Credit Funds: NAV calculations aggregate individual loan valuations, adjust for defaults, apply recovery assumptions, and incorporate accrued interest. This isn't a "market price", rather, it's a sophisticated methodology requiring specialized aggregation logic.

Real Estate Tokens: Property valuations depend on appraisal methodologies, comparable sales analysis, rental income projections, and market-specific factors. Each property type demands different approaches.

Commodity-Backed Tokens: Proof-of-reserve requires audited inventory verification, quality certifications, and custody attestations. These are specialized oracle capabilities far beyond standard price reporting.

Generic oracle solutions are architected for exchange-traded assets with straightforward market prices. Adapting these systems for complex tokenized assets requires substantial customization, and even then, the lack of domain-specific expertise creates verification gaps that protocols can't accept.

What Specialized Infrastructure Provides

Purpose-built data infrastructure like EO's Network addresses these requirements through:

Asset-Specific Methodologies: Rather than forcing every asset through generic price feed logic, specialized infrastructure applies domain-appropriate aggregation:

NAV calculations for funds incorporating credit risk models

Appraisal-based valuations for real estate with market adjustments

Proof-of-reserve frameworks for commodity-backed tokens

Risk-aware pricing that accounts for illiquidity premiums and correlation factors

Cryptographic Verification: Data is broadcast on-chain with cryptographic signing, providing protocols with verifiable provenance and manipulation resistance. This isn't trust in asset managers' self-reported data. It's independent infrastructure validation.

Multi-Chain Delivery: For tokenized assets to be usable across DeFi protocols on different networks, verified data must be consistently available on Ethereum, Base, Arbitrum, and other chains such as Plume where EO Network provides native infrastructure. Specialized infrastructure ensures synchronized delivery without relying on external bridge providers (which have proven unreliable and created security vulnerabilities for other oracle systems).

Institutional Security Standards: With $8B in staked ETH security and 130+ globally distributed validators, infrastructure providers like EO Network deliver the institutional-grade security model that sophisticated protocols demand for high-value integrations.

Part 5: Real-World Implementation: The mF-ONE Case Study

The Fasanara Capital mF-ONE fund demonstrates how all three tokenization layers work together in production. As of October 16, 2025, the fund holds $147.3 million in assets under management, with deep integration into institutional DeFi protocols.

The Complete Stack in Action

Asset Layer (Fasanara Capital): Fasanara manages a diversified European SME private credit portfolio, providing the underlying asset expertise: credit underwriting, loan management, default mitigation, and recovery optimization.

Platform Layer (Midas): Midas structured the legal framework, deployed smart contracts across multiple chains (Ethereum, Base, Arbitrum), and handles investor administration with programmatic compliance enforcement.

Infrastructure Layer (EO Network): EO Network provides specialized data infrastructure that enables real-time NAV broadcasting, cryptographic proof-of-reserve, and multi-chain data delivery. Rather than quarterly reports, protocols receive daily valuations calculated from Fasanara's portfolio performance using credit-specific aggregation logic.

Enabling Real Utility

This infrastructure enables mF-ONE to achieve meaningful DeFi integration:

Morpho Lending Markets: Morpho's permissionless lending protocol accepts mF-ONE as collateral in curated vaults. Investors can borrow stablecoins against positions without redemption, maintaining exposure to private credit yields while accessing liquidity. This only works because Morpho trusts EO Network’s NAV feeds for real-time collateral valuation. When portfolio performance changes, collateral requirements adjust automatically.

Yield Optimization Strategies: With mF-ONE integrated into lending protocols, advanced institutional strategies become possible, including sophisticated yield composition and risk-managed leverage. Strategies like automated rebalancing based on real-time yield data, PT (Principal Token) looping for amplified returns, and cross-asset composition combining mF-ONE with other tokenized credit instruments.

Institutional Risk Management: Curators like Steakhouse Financial structure vault strategies using mF-ONE, setting appropriate loan-to-value ratios based on asset characteristics and monitoring performance via EO Neytwork's data feeds. This institutional-grade risk management signals credibility to sophisticated allocators.

The Infrastructure Difference

The distinction between static certificates and composable assets becomes concrete in this example:

Without specialized infrastructure: Token issued, quarterly NAV reports published on platform website, peer-to-peer trading possible, but no protocol accepts as collateral (can't verify valuations), no automated strategies integrate (data quality uncertain), token remains static certificate.

With specialized infrastructure (mF-ONE model): Token issued with real-time NAV infrastructure, daily valuations broadcast on-chain with cryptographic verification, lending protocols accept as collateral (trusted independent data), automated strategies integrate (reliable feeds), investors access borrowing and yield optimization, token becomes composable financial primitive.

Infrastructure quality determines which path a tokenized asset follows.

Part 6: Requirements for Successful Tokenization

Based on successful implementations like mF-ONE and broader market developments, three requirements must be met simultaneously:

1. Legal and Regulatory Framework

Tokenized assets must map to recognized legal structures with clear compliance pathways:

Legal entity formation (SPVs, trusts) holding underlying assets

Securities law compliance appropriate to the jurisdiction and target investor base

Transfer restrictions and investor eligibility enforcement

Corporate action mechanisms with binding legal authority

Progress is accelerating. Multiple jurisdictions globally have enacted frameworks providing legal clarity for tokenized securities. This requirement is increasingly solved.

2. Platform Infrastructure

Tokenization platforms must handle issuance mechanics and lifecycle management:

Smart contract deployment with embedded compliance logic

Investor onboarding and administration (KYC/AML, accreditation)

Multi-chain deployment and interoperability

Corporate action execution and reporting

Multiple providers (Midas, Securitize, Centrifuge) have proven infrastructure. Platform choice matters, but platform existence is no longer the constraint. In fact, the bottleneck has shifted to specialized data infrastructure.

3. Data Infrastructure (The Current Bottleneck)

Specialized infrastructure providing verifiable, real-time valuations determines whether tokens achieve meaningful utilization beyond peer-to-peer trading. This requirement is currently the limiting factor for market scaling.

Protocols demand:

Domain-specific aggregation methodologies for complex assets

Independent verification (not issuer-reported data)

Cryptographic signing with clear provenance

Manipulation-resistant security models

Multi-chain synchronized delivery

Without this infrastructure layer, tokenized assets can't integrate with lending protocols, automated strategies, or institutional risk management systems. Most tokenization failures occur here. Platforms issue tokens without ensuring data infrastructure, creating digital wrappers that never achieve composability.

Key Consideration: Ongoing Investment in Specialization

Infrastructure specialization requires continuous investment in domain expertise as new asset types emerge. Each asset class, for example, private credit, real estate, commodities, and structured products, demands tailored valuation methodologies. This represents both a challenge (ongoing development required) and a moat (domain expertise creates defensible positioning for specialized infrastructure providers).

Conclusion: Infrastructure Enables the $16 Trillion Opportunity

The path from $33.91 billion in tokenized assets today to $16 trillion by 2030 depends fundamentally on infrastructure scaling to meet institutional demand.

Technology is solved: Blockchain networks handle institutional throughput. Smart contract platforms support sophisticated compliance logic. Tokenization platforms have proven issuance capabilities.

Demand is proven: Major institutions recognize tokenization's efficiency gains and are deploying real capital into tokenized structures. The market signal is unambiguous.

Infrastructure is the bottleneck: Without specialized data infrastructure providing verifiable, real-time valuations, tokenized assets remain static certificates. Protocols won't accept them as collateral. Automated strategies won't integrate them. Institutional risk managers won't trust them.

The mF-ONE case study demonstrates what becomes possible when all three layers execute properly: $147M in assets under management with deep DeFi integration, real utility enabling collateralized borrowing and yield optimization, and institutional credibility attracting sophisticated allocators.

For the tokenization market to achieve its projected growth, infrastructure must be treated as foundational rather than ancillary, embedded from project inception rather than retrofitted after token launch. Asset managers evaluating tokenization should ask: What data infrastructure will provide valuations protocols trust? Tokenization platforms should integrate specialized infrastructure from project inception. DeFi protocols should demand independent verification with domain-appropriate methodologies.

The $16 trillion question isn't whether blockchain can handle the volume. It's whether infrastructure can scale to make those trillions trusted, verifiable, and composable. That infrastructure layer is where traditional assets genuinely move on-chain.

About EO Network

EO Network provides specialized blockchain oracle infrastructure enabling institutional-grade tokenization. With $8B in staked ETH security, 130+ globally distributed validators, and purpose-built data solutions for complex assets across 20+ chains, EO Network powers the data layer making tokenized assets trusted and composable.

Learn more at eo.app.